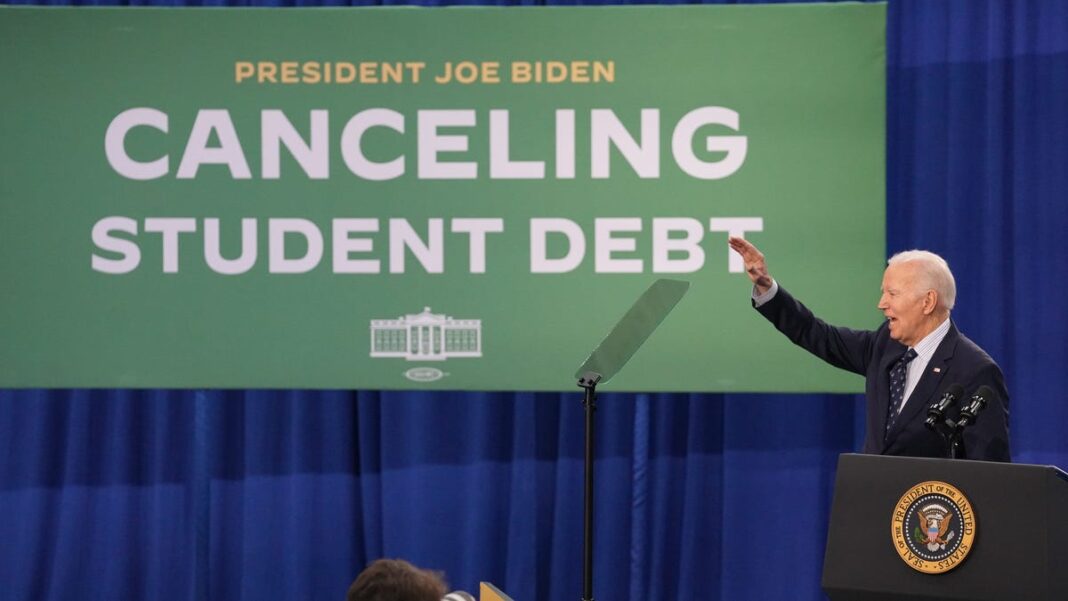

Biden cancels $4.5 billion in student loans for 261,000 borrowers

The Department of Education also suggested prohibiting a past corporate executive from managing any college that benefits from federal aid.

WASHINGTON – The Biden administration has authorized its final significant student loan forgiveness initiative, granting $4.5 billion to 261,000 borrowers.

The individuals receiving this debt relief studied at Ashford University, a now-defunct for-profit institution that the U.S. Department of Education found to have made “significant misrepresentations” regarding its academic offerings and associated costs for federal student loan borrowers. Ultimately, Ashford was absorbed by the University of Arizona, which used Ashford’s parent company, Zovio, to manage its University of Arizona Global Campus.

The federal agency approved this relief under a provision known as borrower defense to repayment, which allows the government to forgive loans for students who were defrauded. Borrowers eligible under this provision typically attended schools that were later found to have committed ethical breaches, including inflating claims about potential salaries after graduation.

James Kvaal, the education undersecretary, stated on Wednesday that local and state investigations revealed that 90% of Ashford students did not complete their degrees. Those who did graduate were often burdened with significant debt and struggled to find well-paying jobs, he noted.

“Today’s announcement brings much-needed relief to students wronged by Ashford’s actions,” Kvaal remarked.

This latest round of debt cancellation follows the recent announcement that the administration has achieved nearly $200 billion in student loan forgiveness for over five million borrowers during Joe Biden’s presidency. Although Biden aimed to relieve student loan debt for tens of millions of individuals, his administration faced hurdles, including opposition from Congress and legal challenges.

On Wednesday, the Education Department also put forth a proposal to prevent Andrew Clark, Zovio’s founder, from overseeing any institution that receives federal financial aid. Clark left the company in 2021. At that time, Zovio’s board chair commended his leadership in orchestrating a “historic sale” and claimed he had established a strong foundation for the company to enhance its educational technology services.

As President-elect Donald Trump prepares to assume office, advocates for borrowers fear that the borrower defense program might shift back to the more restrictive version that existed during Trump’s presidency, which processed far fewer applications. According to department officials, there are still several hundred thousand borrowers awaiting decisions on their borrower defense discharge requests.

The Supreme Court recently agreed to review the Biden administration’s challenge to a lower court ruling that blocked a regulation intended to streamline the approval of borrower defense discharges. This rule has been on hold since 2023.

This situation is indicative of many college affordability initiatives put forward during the Biden administration that are currently facing legal obstacles. In his farewell speech at the Department of Education in Washington, D.C., on Tuesday, outgoing Education Secretary Miguel Cardona expressed uncertainty about which regulations would remain effective under the next administration but conveyed optimism for the future of American students.

“We can’t dwell too long on uncertainty,” he remarked. “The fact is, I’m leaving here filled with hope.”

Zachary Schermele is an education reporter. Follow him on X at @ZachSchermele.