The stock market is thriving, but there’s a crucial downside

The market is now more vulnerable to extended downturns than in previous years.

Have you noticed that stocks seem to be offering fewer substantial returns than they used to? This perception is not entirely unfounded. The market dynamics have felt off since the dot-com crash of the early 2000s. Even when disregarding the notable fluctuations since then, long-term gains have seemed lackluster.

However, the reality is that the S&P 500 index remains as productive as ever, with average annual returns just under 10%, excluding dividends. Including dividends raises the average annual return to over 11%.

But there’s an important twist. Unlike before the year 2000, you now need to hold your investments for a full 20 years to secure the dependable gains investors expect from the stock market. Shorter investment horizons of five or ten years might not be sufficient.

Times have changed significantly

There was a period when marketing from mutual funds and brokerage firms emphasized that there hadn’t been a decade since The Great Depression where the market had lost value. Impressively, the S&P 500’s rolling 10-year return remains strong. Even after the 2008 mortgage crisis, which closely followed the dot-com market crash eight years earlier, this statement still holds true.

Still, there’s a concerning “just barely” trend in the figures that may give investors, already anxious about the performance of today’s market, something to stress over.

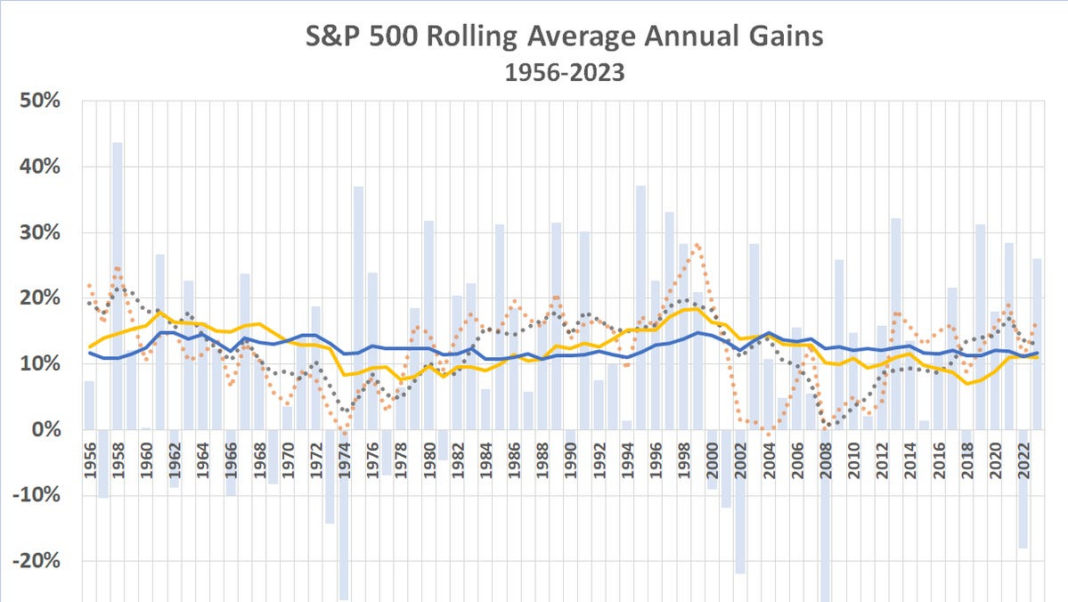

The illustration below illustrates the situation by comparing the average annual returns (and losses) of the S&P 500 over rolling five-year, 10-year, 20-year, and 30-year frames since 1956. The five-year and 10-year average returns, indicated by lighter dots, are not the primary focus here. However, they have occasionally been near, at, or below zero several times since the mid-1950s.

It’s worth noting that during the 1970s, the 20-year rolling average annual returns fell into the single digits and stagnated for many years. Just a few years ago, the 20-year average gain was also unimpressive, remaining below 10%.

Even so, these subpar returns have outperformed alternatives during that time span and kept ahead of inflation.

If you aim to build wealth over the long term, investing in stocks remains the most effective strategy. Investors simply need to adopt a longer-term perspective, focusing on 20-year time frames instead of traditional five- or ten-year periods. The periods of extended poor performance can significantly disrupt retirement plans.

Rethinking stock selection strategies

What do these insights mean for your investment strategy?

<pPrimarily, it emphasizes the importance of considering the long-term sustainability of companies’ business models. Will there still be demand for their products or services in a few decades?

For instance, consider Charter Communications, a cable company. While it’s true that television will still be a staple in our lives, will consumers choose to purchase customized, on-demand programming from studios in the future, bypassing traditional cable services?

Conversely, it’s likely that we will continue to use some form of portable connected device by 2044.

It’s also important to evaluate company-specific durability.

For a historical example of what not to emulate, look at Johnson & Johnson and General Electric. Three decades ago, both seemed to dominate their industries, perfectly positioned to meet the growing need for industrial and healthcare products. However, hindsight suggests that these companies often resorted to acquiring additional revenue instead of innovating and adapting.

Additionally, high levels of debt have led to the downfall of once-prominent companies like Toys R Us, Bed Bath & Beyond, and Valeant Pharmaceuticals (now primarily known as Bausch).

Moreover, some companies have become synonymous with their founder CEOs, for better or worse. Amazon has continued to perform well since Andy Jassy took over from Jeff Bezos in 2021, but some of the foundational magic could be fading. Similarly, Apple hasn’t quite recaptured its former glory since Steve Jobs’ departure as CEO in 2011.

This isn’t to imply that stocks of companies led by high-profile executives aren’t worth investing in; often they are quite appealing. However, it’s critical to discern whether it’s the business itself or its leadership driving the stock’s value.

It may be wise to consider acquiring a few more stocks that pay dividends while having fewer high-growth stocks in your portfolio. This way, you can secure consistent cash flow now rather than waiting in hope of larger returns in the future. When dividends are reinvested, the overall returns from certain dividend stocks can compete with those of well-known growth stocks.

A fun fact: Research from the mutual fund firm Hartford shows that since 1960, 85% of the S&P 500’s net returns have come from reinvested dividends from its member companies.

Embrace the New Normal

Since the 1960s post-war period, the market environment has changed significantly. Historically, it was less turbulent and more reliable regarding profits and minimized losses. A shift appears to have occurred in the late 1990s, likely due to the internet’s rise and the onset of inexpensive online trading. Since then, market fluctuations have become more pronounced—both upward and downward.

Regardless of the cause, this is the reality every investor has to navigate now. Instead of fixating on predicting a stock’s future values, the focus should be on evaluating the long-term growth potential of the underlying businesses. Essentially, all investors should now aim for companies they can hold onto for a lifetime, perhaps more than ever before. Ultimately, it might take a whole generation for a stock to adequately reward its investors.

The bright side is that, in many respects, this approach to stock selection is actually simpler and requires less time compared to the performance-chasing strategies that many investors currently pursue.

John Mackey, the former CEO of Whole Foods Market, which is part of Amazon, serves on The Motley Fool’s board of directors. James Brumley holds no shares in the stocks mentioned. The Motley Fool invests in and endorses Amazon and Apple. The Motley Fool also endorses Bausch Health Companies and Johnson & Johnson and has an established disclosure policy.

The Motley Fool collaborates with YSL News to provide financial insights, analysis, and commentary aimed at empowering individuals to take charge of their financial future. This content is independently produced by The Motley Fool.

Is it a good time to invest $1,000 in the S&P 500 Index?

Message from the Motley Fool: Before you decide to invest in the S&P 500 Index, consider this:

The Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks for potential investment right now and the S&P 500 Index is not included in that list. The selected 10 stocks could lead to impressive returns in the upcoming years.

Think about the example of Nvidia being listed on April 15, 2005 had you invested $1,000 then, your investment would now be worth $743,952!*

The Stock Advisor service gives investors a straightforward roadmap to successfully build their portfolios, including expert insights and two new stock recommendations each month. Since its inception in 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.