Before you start claiming Social Security in 2025, consider the implications of applying too early or too late.

Are you thinking about retirement? Perhaps you’re planning to exit the workforce for good in the next year. If that’s the case, well done! You’ve earned the chance to prioritize your own well-being over work.

However, before you finalize your departure and begin your Social Security benefits in 2025, take a moment to evaluate the financial consequences of taking benefits now versus waiting.

Should you start Social Security at 62 or wait until 67?

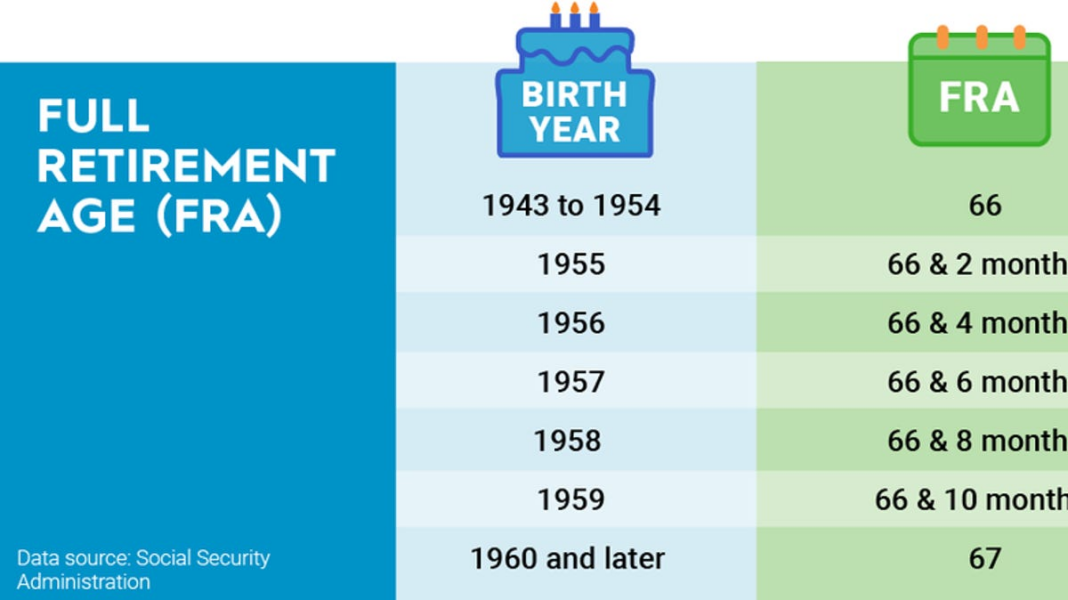

You have the option to start collecting Social Security benefits as early as age 62, but doing so will mean receiving less money overall. Those who postpone their claims until reaching their full retirement age, which ranges from 66 to 67 based on your birth year, will see larger monthly payments.

Choosing to start benefits early can lead to a significant decrease in your monthly payments, with reductions of up to 25% to 30%, depending on your age.

The penalty for claiming benefits reduces as you approach your full retirement age (FRA). For instance, if you apply 12 months before reaching FRA, your monthly benefit would only be decreased by 6 2/3% of what you would receive at FRA.

Given that the average monthly Social Security payment is just over $1,900, this potential reduction is substantial for many individuals, potentially translating to a few hundred dollars less each month.

Is it beneficial to delay Social Security until age 70?

On the flip side, you can increase your monthly benefits further by delaying your claim past your FRA. Those who wait until they turn 70 can receive monthly payments that are 15% to 25% higher than what they would have received at their FRA. The table below clearly shows the financial impact of claiming early vs. delaying benefits.

Source of data: Social Security Administration.

Your next steps should be to connect with the Social Security Administration—whether online, in person, or via phone—to explore your current benefit options. You could discover that extending your work for another year is worthwhile, or you might find that there’s little benefit in delaying until 70.

It’s important to note that once you turn 70, there’s no additional benefit to waiting to file your claim. In fact, doing so might mean you miss out on potential funds because the Social Security Administration only allows retroactive benefits for six months. If you wait more than seven months to start your claim, you’re foregoing money that you’ll never recover.

How does Social Security pay — by check or direct deposit?

Besides comparing your estimated Social Security benefits, you have other important considerations if you’re planning to claim soon. You’ll need to ensure that you have an efficient means of receiving payments (remember, direct deposits are the norm now, not paper checks) and confirm that the Social Security Administration has accurate records regarding your income history. Mistakes can happen, even if you’ve been consistent with your Social Security tax contributions throughout your career.

A crucial task on your pre-retirement checklist is to develop a financial plan for when you retire. Do you have cash set aside in a low-interest checking account, or are you able to allocate some funds into higher-yield investments that you can access easily? Is your investment strategy still focused on growth? If that’s the case, this is the right moment to adjust it, as markets can shift rapidly in just a few months. Additionally, if you’re currently covered by an employer’s health plan, consider looking into supplementary Medicare coverage.

No matter what your future looks like, it’s always beneficial to start gathering information and planning your finances. Understanding your financial situation is a significant first step.

Effectively managing your finances during retirement is equally vital.

The Motley Fool has a disclosure policy.

The Motley Fool is a YSL News content partner offering financial news, analysis, and commentary designed to assist individuals in taking control of their financial futures. Its content is produced independently from YSL News.

The $22,924 Social Security bonus that many retirees ignore

Offer from the Motley Fool: If you’re like most Americans, you may be behind on retirement savings. However, a few little-known “Social Security secrets” could help increase your retirement income. For example, here’s a simple trick.

You could potentially earn an additional $22,924 annually! By understanding how to optimize your Social Security benefits, we believe you can retire with confidence, achieving the peace of mind we all seek.