Economists Support Legislative Move for Transparency in Health Care Prices

The cost of an MRI can vary widely—ranging from $300 to $3,000—while a colonoscopy could set you back anywhere from $1,000 to $10,000.

These disparities illustrate the unpredictable nature of health care pricing, prompting economists to urge Congress to require hospitals and health providers to disclose their medical care costs transparently.

Proponents of the Health Care Price Transparency Act 2.0 hope that a collective effort from notable economists will persuade lawmakers to push forward with a Senate bill introduced by Senator Mike Braun (R-Indiana) last December. This legislation, co-sponsored by 11 other senators from both parties along with Bernie Sanders, an Independent from Vermont, has yet to move past the committee stage. Braun’s main objective is to advance this bill out of committee for a full Senate vote, according to his deputy communications manager, Allison Dong.

In a letter sent to senators on Monday, 32 economists along with academics and business leaders indicated that enforcing price transparency could save up to $1 trillion in unnecessary medical expenses annually and would assist middle-class families struggling with soaring health care costs.

The economists maintained that reducing costs for patients could rejuvenate the economy by allowing workers to keep more of their earnings, which currently are impacted by soaring health care expenses borne by their employers.

Vivian Ho, an economist from Rice University who endorsed the letter, stated that this legislation would empower both employers and consumers by providing them with tools to compare prices for better health care options. She believes that enabling individuals to select lower-cost hospitals, labs, and same-day surgery centers could help slow down health spending and potentially reduce health insurance premiums.

“A significant portion of middle-class wealth in the U.S. is tied up in hospital cash reserves,” commented Ho, who also holds the Baker Institute Chair in Health Economics at Rice.

What Would the Price Transparency Bill Entail?

Currently, hospitals are required to disclose certain pricing information. A federal regulation that began in 2021 mandates that hospitals display cash prices and the rates negotiated with health insurers for a wide array of procedures in a format that can be easily analyzed. Additionally, hospitals must provide price estimates for at least 300 services to facilitate consumer comparisons.

However, critics argue that the existing federal regulation contains too many loopholes. They claim the price estimator tools may not reflect actual prices and that the machine-readable files are often filled with incomplete, inaccurate, or non-functional data. According to the Centers for Medicare & Medicaid Services, 15 hospitals have been penalized for failing to comply with price posting requirements.

The Braun bill would mandate that health care providers submit computer files containing all negotiated rates and cash prices with hospitals, health insurance plans, labs, imaging centers, and same-day surgery facilities. These providers would need to disclose actual prices rather than estimates, with federal regulators defining the reporting format.

Health care executives would be required to verify the accuracy and completeness of all presented prices under threat of penalties, which would scale according to the size of the hospital. For instance, a 500-bed hospital failing to comply could incur a penalty of up to $10 million.

Hospitals have expressed concern that this legislation may remove price estimates, which they believe could confuse consumers.

In a letter submitted to a Senate committee during a July hearing, the American Hospital Association cautioned that removing price estimates would be unwise.

They argued that discontinuing price estimates would take away “a consumer-friendly research tool” and would disproportionately penalize hospitals that have invested heavily in complying with existing regulations, stating that list prices might confuse consumers and fail to account for varying insurance policies that influence the final charge for services.

Conversely, employer groups contend that actual prices are more important than estimates. Companies offering health insurance to working Americans need to access real prices when administering benefits for their employees.

James Gelfand, president and CEO of The ERISA Industry Committee, a trade association for employers, emphasized that price transparency would enable employers to make informed decisions about the benefits they offer to their workforce and their families.

“Transparency is essential for controlling health care expenses for both employers and workers,” Gelfand stated, adding that Braun’s bill is the most robust in calling for the disclosure of actual prices rather than estimates.

Other experts have pointed out that consumers are more inclined to shop for health care when they are aware of the prices. More transparent health care vendors, including platforms like GoodRx, entrepreneur Mark Cuban’s Cost Plus Drugs, and Amazon, provide consumers with clear pricing options, noted Ge Bai, a professor of accounting and health policy at Johns Hopkins University.

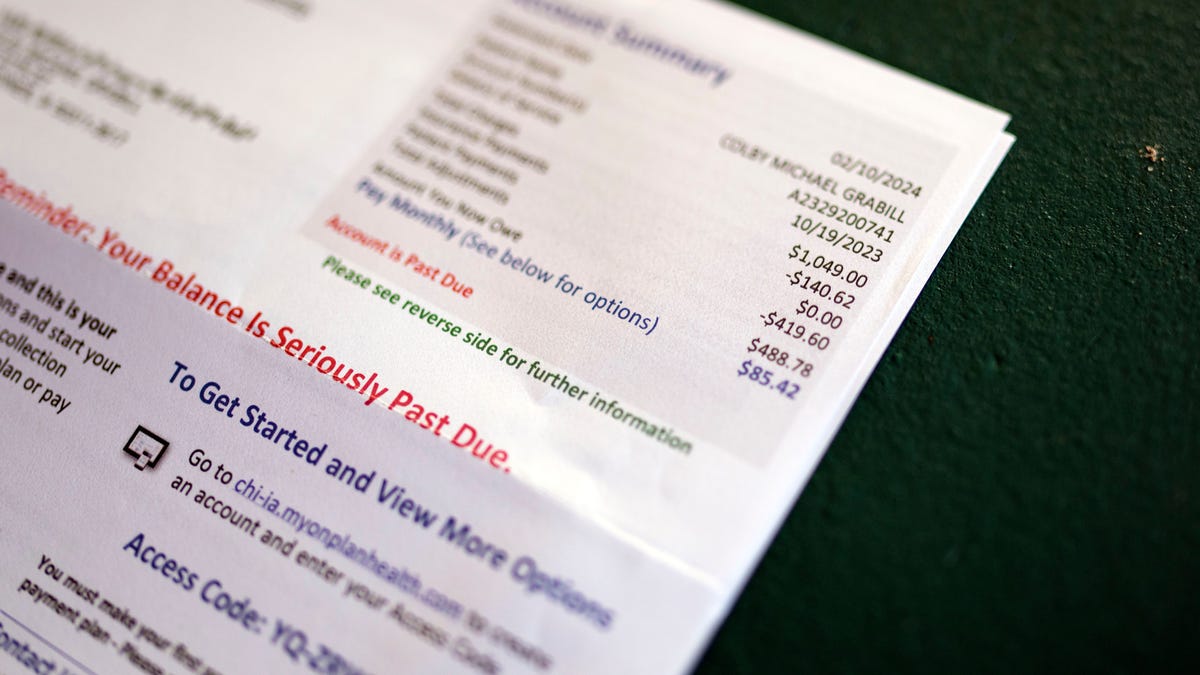

She indicated that improved price transparency would allow consumers to compare prices across various hospitals and clinics before undergoing medical procedures. With about 100 million Americans facing medical debt, having such a tool could empower consumers to find better prices and avoid unexpected bills.

“Consumers are increasingly keen to manage their health care expenses, and price transparency will facilitate that,” Bai said.

Escalating Health Costs Weigh Heavily on Workers’ Earnings

The economists assert that the surge in medical costs has compelled both employers and consumers to allocate more funds to health care. They referenced a 2023 Kaiser Family Foundation report that indicated the average family cost of health insurance plans has surged to nearly $24,000 annually, which represents a 50% increase compared to ten years ago.

Employers typically bear a majority of the health insurance costs, which limits their ability to hire additional employees or provide salary increases, according to Ho.

Many companies do not recognize that escalating healthcare expenses often result in smaller salary raises. This is a compromise businesses face when assessing overall employee compensation.

Research conducted by Willis Towers Watson indicates that 40% of the salary increases received by low-wage workers since 2000 have been allocated towards healthcare premiums, the economists stated in their letter.

“Workers often overlook this,” Ho remarked. “They focus solely on their take-home pay, without consistently considering the portion consumed by premiums.”