Tax cuts, tariffs, and deportation: How economists say Donald Trump could raise inflation

In a recent discussion about childcare expenses at the New York Economic Club, Donald Trump mentioned tariffs, claiming they could bring in trillions for the government.

He remarked, “While childcare is often regarded as costly, it’s actually not that expensive in comparison to the revenue we’ll be generating,” as he digressed from the question asked.

However, Trump’s focus on tariffs, along with his support for tax reductions and the deportation of undocumented immigrants, contradicts his goal of eliminating inflation. American citizens consistently cite inflation as a primary concern. Even though inflation rates have decreased to 2.5%, many are frustrated that prices have not returned to pre-pandemic levels: food costs have risen by 20% since 2020, and housing remains increasingly unaffordable. This topic was a key discussion point in the recent presidential debate.

Both candidates in the presidential race have pledged to tackle inflation and the escalating cost of living. Yet numerous economists point out that Trump’s proposals, especially his emphasis on tariffs, may exacerbate inflation.

Despite these concerns, Trump retains significant backing from business leaders due to his other proposals focused on deregulation and reducing corporate taxes.

A statement from campaign spokesperson Karoline Leavitt attributed inflation to Vice President Harris’s “tie-breaking vote in favor of the $400 billion Inflation Reduction Act and her support for President Biden’s assault on our domestic energy sector.”

Economists express worries

Goldman Sachs, a major investment bank, cautioned this month that Trump’s comprehensive tariff plan could increase inflation by up to 1.2% by 2025.

Additionally, Trump’s tax cuts, which might inflate the deficit and pressure the Federal Reserve to reduce interest rates, along with his plan for mass deportations, could also drive up inflation.

Some economists argue that with unemployment at historic lows and wages rising, significant tax reductions and lower interest rates could stir up inflation. Inflation is typically caused by demand outpacing supply, and Trump’s proposed tax and interest rate cuts would likely increase demand for goods.

A tight labor market means supply may struggle to keep up. Furthermore, if millions of workers are deported, it could lead to supply shortages, according to several economists.

In July, a majority of economic experts surveyed by the Wall Street Journal indicated that inflation would be more pronounced under Trump compared to a Biden reelection. This followed a letter from 16 Nobel Prize-winning economists in June expressing their “deep concern about the risks that a second Trump administration could impose on the U.S. economy.”

“Nonpartisan researchers … predict that if Donald Trump implements his proposed policies, it will lead to elevated inflation,” noted the Nobel laureates.

Conversely, some experts highlight that during Trump’s first term, he imposed tax cuts and tariffs without causing runaway inflation.

Research fellow E.J. Antoni from the Heritage Foundation, a conservative think tank, stated, “Many today assert his policies would induce inflation; these are the same voices that claimed his previous policies would lead to inflation, yet the anticipated surge did not materialize.”

Trump’s vague inflation goals

Although Trump promises to “eliminate inflation,” he has not put forward detailed plans on how to achieve this.

As economist and public policy professor Justin Wolfers from the University of Michigan pointed out to YSL News, “‘Eliminate inflation’ doesn’t constitute a policy. Simply stating ‘I will consult with others for ideas on how to diminish inflation’ is not a solid strategy.”

Kimberly Clausing, a senior fellow at the Peterson Institute for International Economics, told YSL News, “His platform is quite inflationary. We rarely see campaign platforms as inflation-inducing as this.”

Here are four of Trump’s strategies that economists like Clausing argue would contribute to rising inflation and their mechanisms:

Tariffs expected to cost households $2,600

A tariff is a tax on imported goods, which supporters argue benefits local industries. Trump has proposed a 10% to 20% tariff on all imported goods, totaling about $3 trillion annually, with a staggering 60% rate specifically for products from China.

In 2018, Trump enacted tariffs on $380 billion’s worth of imports. He stated that foreign countries bear the tariff costs, but a report from the National Bureau of Economic Research revealed that “the entire burden of tariffs falls on American consumers.” A study by the New York Federal Reserve indicated that Trump’s tariffs have cost the average household approximately $831 per year.

Trump’s upcoming and broader tariff imposition would burden

A typical middle-class family will spending more than $2,600 yearly due to economic policies, as indicated by the Peterson Institute.

The left-leaning Center for American Progress Action Fund has projected that a typical family’s yearly expense related to Trump’s policies could reach as high as $3,900. This figure is frequently mentioned by Vice President Kamala Harris, who also informed the New York Times that she would implement targeted tariffs to bolster American workers.

“Every dollar gained from tariffs will result in higher costs for Americans,” stated Wolfers. “This could lead to a significant inflation spike not seen in a while.”

Some economists and groups like the Coalition for a Prosperous America argue that the inflation impact of tariffs may not be as harsh in the long term, as consumers gradually shift to locally produced goods.

“If foreign producers try to pass on the entire cost, Americans may opt for alternatives,” Antoni remarked. “To stay competitive, they would have to absorb some of those costs themselves.”

Tax cuts and government borrowing drive demand

During Trump’s presidency, he enacted tax reductions for both corporations and individuals, which the Congressional Budget Office has estimated will cost $1.9 trillion over the next decade.

These tax cuts were not financed by trimming spending, resulting in an additional $8.4 trillion in borrowing during his presidency—almost double what President Biden has incurred.

Tax reductions without corresponding cuts in spending might lead to inflation, as the influx of money into the economy tends to drive up demand. With prices determined by supply and demand, increased demand often results in higher costs.

Conversely, some research indicates that budget deficits do not substantially affect inflation in developed nations. Even with growing deficits under Presidents George W. Bush, Barack Obama, and during Trump’s first term, inflation remained stable until 2021.

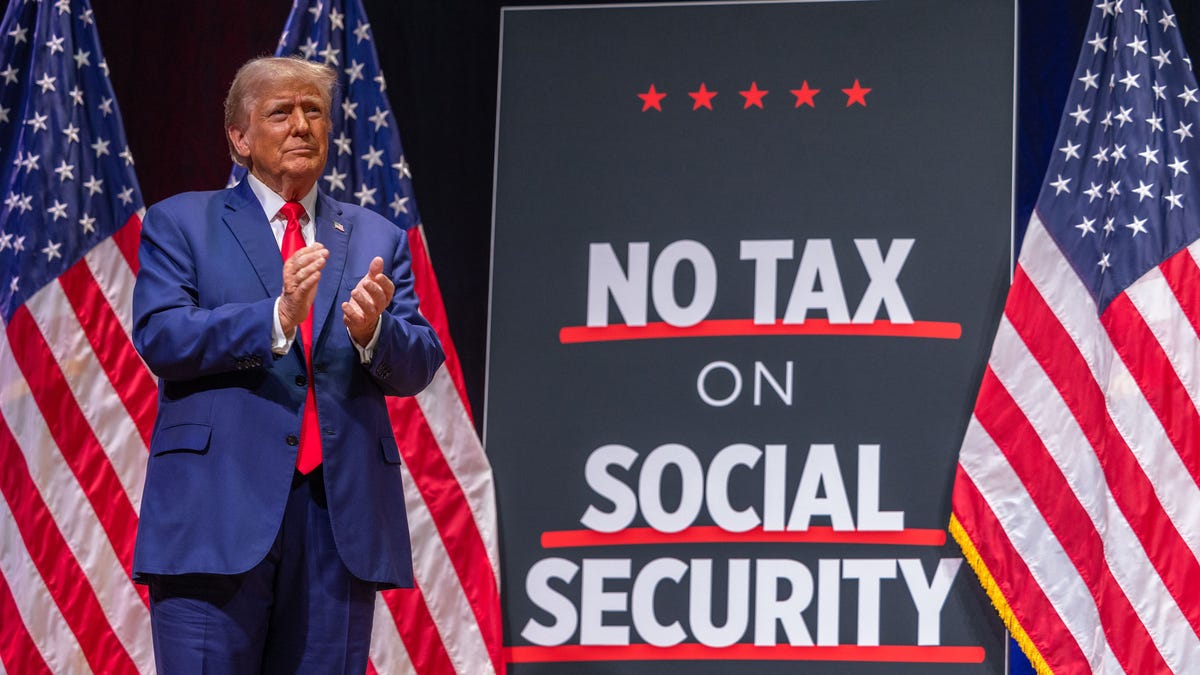

Trump is advocating for the extension of his tax cuts, set to expire in late 2025. This includes reducing the corporate income tax from 21% to 15% and exempting Social Security benefits from income tax, which the Penn Wharton Budget Model assesses would add $5.8 trillion to the national debt over ten years.

In contrast, Harris’ proposals are expected to increase the debt by $1.2 trillion over ten years, primarily due to her plans to enhance the child tax credit, per Penn Wharton projections.

Many of Trump’s fellow Republicans and conservatives express concerns that his spending habits would trigger inflation.

“Running large deficits during full employment leads to inflation,” noted Doug Holtz-Eakin, former chief economist of the President’s Council of Economic Advisers under George W. Bush. “There’s little indication that (Trump) is concerned about budget deficits.”

Deportation of workers may lead to labor shortages

In labor markets, similar to other markets, costs are determined by supply and demand, which means that a lack of labor can drive up wages. Labor shortages can also lead to product shortages, causing price hikes.

Many news articles highlight businesses facing difficulties due to a lack of available workers. Within the workforce, there are millions of undocumented immigrants, whom Trump has pledged to eliminate with “the largest deportation operation in our nation’s history.”

This action could likely lead to labor shortages in sectors heavily reliant on immigrant labor, such as agriculture.

“Such disruptions would likely increase inflation because fewer workers mean challenges in picking apples or other goods, subsequently hurting the economy’s supply side,” Wolfers explained.

“When you remove labor and compel them to leave the country, the production of those goods becomes limited, directly raising their prices,” said Clausing, a former economist at the Treasury Department.

Political Pressure on the Federal Reserve to Reduce Interest Rates

During his time in office, Trump departed from the traditional practice of allowing the Federal Reserve to independently set interest rates. He consistently claimed that interest rates were too high and criticized Fed Chairman Jerome Powell, whom Trump appointed, labeling him a “bonehead” for maintaining rates in 2019.

“I believe the president should have some influence in that area. I am quite firm about that,” Trump stated at a press conference. “I have been very successful in business. I believe my instincts about this matter are better than those of many who are part of the Federal Reserve system — or the chairman himself.”

When interest rates are cut, it typically results in higher inflation. This occurs because lower rates reduce borrowing costs and encourage spending, thereby boosting consumer demand.

Additionally, some economists suggest that turning the Fed into a political battleground could lead to market instability, potentially triggering an inflationary cycle.

“This is a scenario we’ve witnessed before,” Wolfers remarked. “(President Recep Tayyip) Erdogan did something similar in Turkey, where inflation is currently around 60 to 70%.”

An independent central bank is crucial for managing inflation, according to findings from the International Monetary Fund, the World Economic Forum, and various academic studies.

However, Wolfers emphasizes that “Trump has explicitly stated that he aims to weaken that independence.”

Kamala Harris’s Potential Impact on Inflation

Harris has a contrasting strategy for addressing cost issues compared to Trump.

Instead of vowing to eliminate inflation entirely, Harris aims to tackle specific high expenses that burden low and middle-income families. For instance, she has suggested implementing a federal ban on price gouging for food and intends to maintain and expand price caps on prescription drugs, such as the Biden administration’s $35 monthly limit on insulin costs, which has faced opposition from Republicans.

Additionally, Harris has proposed strategies to combat escalating housing costs through down payment assistance, a tax credit for first-time homebuyers, and incentives for new housing development.

However, some critics worry these measures may lead to unexpected inflationary pressures. Experts from the American Enterprise Institute Housing Center, including Edward Pinto and Tobias Peter, argue that providing subsidies to homebuyers might aggravate high housing prices by increasing demand.

Another route through which Trump could potentially reduce inflation involves triggering an economic downturn, a concern expressed by many economists.

“If you were to deport everyone, that might take out around 6% of the workforce, leading to a significant recession. Typically, recessions result in very little inflation,” quipped Holtz-Eakin. “If productivity remains the same and you remove 6% of output, you lack the workforce needed for production. You end up with decreased production and income. Our economy relies heavily on immigration. Without it, we will face a contraction.”