CEO enjoyed high pay as his hospital chain crumbled. Here are the ones who were affected.

Donna Gittens felt exhausted while she struggled to speak. Her dinner with her husband and friends had to be postponed. She was concerned she might be having a stroke.

Gittens was hurried to Carney Hospital, which is located just a few minutes from her home in Boston’s Dorchester area. Emergency care last summer involved two facilities as doctors worked to identify the cause of her condition. Although her diagnosis was a brain infection, she credits the doctors and nurses at her local hospital for saving her life.

Now, she fears that others in her community may not receive the same level of emergency care.

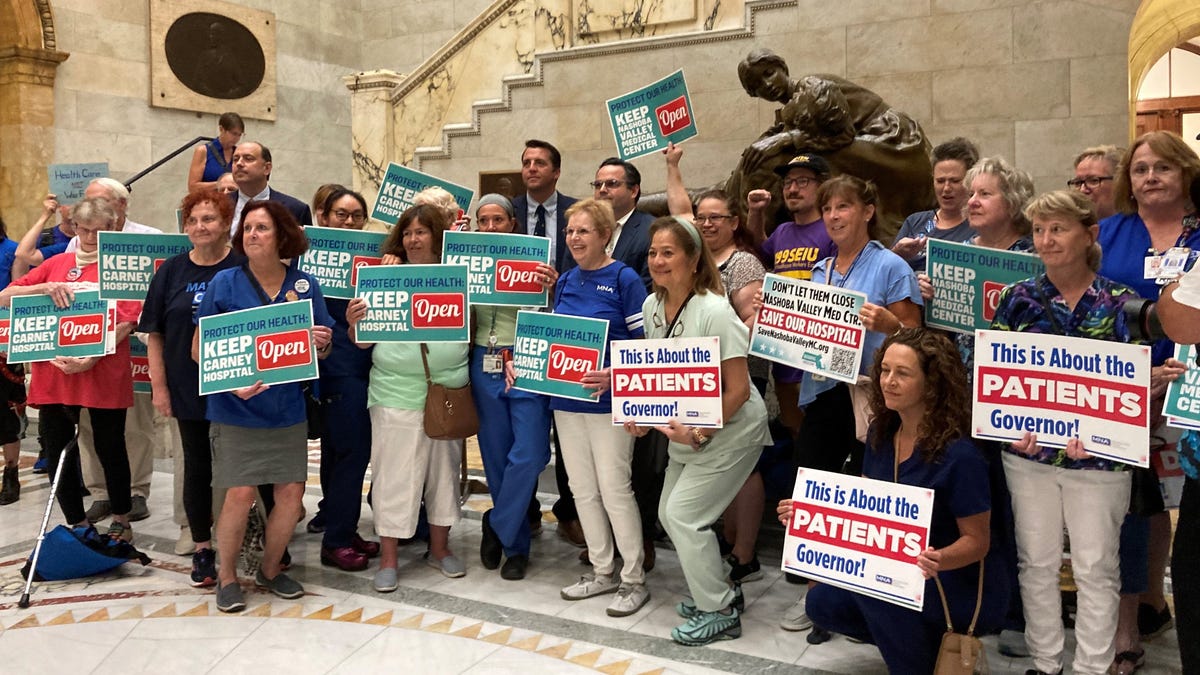

Carney Hospital is one of two facilities in Massachusetts slated for closure on August 31 due to recent turmoil at Steward Health Care. This struggling for-profit hospital chain filed for bankruptcy on May 6 and has been facing difficulties with patients and creditors across several states.

The chain is operated by a former heart surgeon who received over $100 million in compensation and even purchased a $40 million yacht, while staff at Steward hospitals have complained about shortages of essential supplies, per a Senate committee’s findings. More than 2,200 employees are anticipating layoffs in Massachusetts and Ohio based on notices sent to state authorities.

The CEO of the company, who lawmakers indicate has ignored repeated requests to answer questions, is scheduled to testify under subpoena before a Senate committee in mid-September to respond to concerns regarding “financial mismanagement” at Steward.

This situation has sparked wider discussions among lawmakers and analysts regarding the impact of private equity in healthcare. Many from the affected communities are questioning why there aren’t protections in place when a corporation takes control of an organization that provides critical health services.

The issue is not limited to Massachusetts. In Arizona, state health authorities temporarily shut down a Steward-owned psychiatric facility after its air conditioning failed during an extreme heatwave. Meanwhile, workers at a West Monroe, Louisiana, hospital reported they had to search the facility for basic medical supplies during procedures. Tragically, one patient died while awaiting transfer to another hospital, prompting regulators to issue an “immediate jeopardy” citation, based on testimony from an April Louisiana House Health and Welfare Committee meeting.

After the bankruptcy announcement, the governor of Massachusetts implemented an emergency plan to oversee the future of the remaining seven hospitals in the state. The company received bankruptcy court approval to close Carney and another location, Nashoba Valley Medical Center in Ayer, by the end of August.

Having faced a health emergency herself, Gittens is concerned that her diverse community will lack access to necessary medical services. In critical situations akin to her own last summer, having prompt care can mean the difference between life and death.

“Carney is essential not just for my family but for the broader community,” Gittens stated.

Despite the urgent appeals from community leaders, the state has no intention of keeping Carney or Nashoba Valley operational. Nonetheless, Massachusetts Governor Maura Healey announced on August 16 that the state plans to use eminent domain to take control of another Steward facility, St. Elizabeth’s Medical Center in Brighton. The state has also reached agreements with other operators to manage the remaining four Steward hospitals.

Healey placed the blame for Steward’s financial troubles on its CEO, Dr. Ralph de la Torre, and the hospital chain’s leadership.

“This situation wasn’t caused by Massachusetts,” Healey remarked. “It stemmed from the greed and exploitation by Ralph de la Torre and his team. Their actions pushed Steward hospitals to the edge of collapse.”

A spokesperson for de la Torre did not respond to inquiries from YSL News regarding the issues affecting various Steward Health Care facilities.

In a statement, the company said it aimed to minimize the impact on patients.

“This is a difficult and unfortunate situation, and we regret the effects it will have on our patients, employees, and the communities we serve,” stated Deborah Chiaravalloti, a representative of Steward. “Steward Health Care is working diligently to ensure a seamless transition for those impacted while continuing to deliver quality care to our patients.”

Lawmakers decry ‘unconscionable corporate greed’

Steward Health Care was established in 2010 when Cerberus Capital Management, a private equity firm, purchased a financially troubled nonprofit hospital network from the Archdiocese of Boston. De la Torre, previously a cardiac surgery leader at Beth Israel Deaconess Medical Center in Boston, became the CEO of the newly formed Steward Health Care.

The Dallas-based operation quickly grew, forming a network of over 30 hospitals with a workforce of more than 30,000. This expansion was largely driven by a strategic move made by de la Torre, which involved selling the land underlying Steward’s hospitals to a corporate landlord, Medical Properties Trust. This sale-leaseback arrangement imposed significant rent obligations on the hospitals. Current bankruptcy documents reveal the company is burdened with $9 billion in debt, of which more than $6 billion is owed in lease payments to its landlord.

Following the bankruptcy filing in May, Steward announced plans to close several hospitals and lay off thousands of workers, leaving community residents anxious about their future healthcare options.

The financial troubles of the chain have drawn the attention of the Senate Health, Education, Labor, and Pensions Committee, which has initiated an investigation into the company’s financial practices. This inquiry is expected to cover Steward Health’s transactions with private equity investors, extravagant expenditures, the lease agreement, and the impending hospital closures.

A subpoena has been issued requiring de la Torre to respond to inquiries regarding the difficulties faced by his company.

During a hearing on July 25, Senator Bernie Sanders, I-Vermont, who leads the committee conducting the investigation, stated that de la Torre ignored numerous requests to appear before the lawmakers. This led to a bipartisan decision to mandate his testimony on September 12.

While Steward was closing its hospitals, Sanders alleged that de la Torre was enjoying a “$100 million payday,” which he used to acquire a $40 million yacht. Furthermore, Sanders mentioned that the executive purchased a $15 million custom fishing boat and had access to two private jets.

According to Sanders, de la Torre “represents the kind of appalling corporate greed that is prevalent in our profit-driven healthcare system.” He added during the hearing, “We’re saying enough is enough. It’s time for Dr. de la Torre to step off his yacht and explain to Congress the financial misconduct that made him extremely wealthy while the hospitals he oversaw went bankrupt.”

When asked about the information sources Sanders relied on for his July statements regarding de la Torre’s financial gains and luxury purchases, his staff provided links to articles from The American Prospect, The Boston Globe, and Becker’s Hospital Review.

Beyond the halls of Congress, Steward is facing additional scrutiny. Reports from CBS and other sources indicate that the Justice Department has initiated a criminal probe into claims of fraud and corruption associated with the company. The Justice Department and the U.S. Attorney’s Office in Boston have declined to comment on whether there is an active investigation of the healthcare chain.

Steward has also come under investigation in Malta, where the company negotiated a €4 billion deal to oversee three hospitals. In May, a Maltese magistrate suggested criminal charges against de la Torre. This inquiry linked back to former Maltese Prime Minister Joseph Muscat, who has been charged with money laundering, corruption, and bribery, and he has pleaded not guilty while facing up to 18 years in prison, as reported by local media.

Increasing Focus on Private Equity in Healthcare

The bankruptcy, hospital closures, and patient care disruptions at Steward are not the only matters the Senate committee plans to investigate. Sanders intends to seek clarity on the expanding role of private equity in the healthcare sector.

At a July hearing, Sanders noted that private equity firms own approximately 460 hospitals in the United States, accounting for about one in five for-profit hospitals.

“How many of these hospitals are burdened with debt to enrich a few executives and private equity firms even further?” Sanders questioned. “How many of these facilities are on the brink of closure? How many patients are in peril?”

Experts express concern regarding the issues surrounding Steward’s bankruptcy and its implications for private equity involvement in healthcare. They suggest that the company’s debt escalated significantly due to its aggressive acquisition of hospitals and medical practices.

Dr. Vikas Saini, president of the Lown Institute, a health think tank based in Massachusetts, asserted that the financial difficulties following Steward’s acquisition efforts were inevitable.

Saini attributes the turmoil to inadequate regulatory oversight of healthcare mergers and acquisitions.

“This situation highlights how lacking our oversight and regulatory framework is for the healthcare sector,” Saini explained. He emphasized that changes in hospital ownership have profound social implications for communities, much more so than matters concerning the construction of an iPhone plant.

According to Saini, hospital ownership transitions need stronger safeguards, transparency, and public accountability. “We have to ensure that we’re not just being sold a deceptive narrative.”

Patients in Louisiana Facing ‘Immediate Jeopardy’

In Louisiana, state health regulators are examining Glenwood Regional Medical Center, owned by Steward, which has received three warnings for “immediate jeopardy” within a 120-day period from December 2023 to early 2024. These warnings highlighted issues that jeopardized patient safety and could lead to the loss of Medicare and Medicaid funding.

Debra Russell, a nurse practitioner who worked at Glenwood for over thirty years before resigning last November, attended an April hearing before a Louisiana legislative committee. She recounted the dire situation facing patients in the hospital. In one instance, she had to change her approach during a procedure because the hospital lacked a $5 tube known as a guide wire. In another case, a young man who arrived at the emergency room following a heart attack could not get in touch with the on-call cardiologist since the specialist hadn’t been compensated. Additionally, when staff attempted to procure medication from the pharmacy for the patient, the needed drug was unavailable because the hospital’s supplier hadn’t been paid.

Russell also witnessed evidence of the financial strain outside the emergency room, noting that coffee machines were being repossessed and document shredding services had stopped servicing the facility.

Steward’s operational days at the hospital appear to be coming to a close. The company announced that another operator, American Healthcare Systems, has expressed interest in acquiring Glenwood. The proposed deal must receive approval from the bankruptcy court.

Steward has declined to comment regarding the sale or current operations at Glenwood. However, in a news release from last May, the hospital stated it was addressing the concerns raised by state and federal regulators following the “immediate jeopardy” citations.

During the recent Senate hearing, Russell described the heartbreaking moments she experienced in her final days at the Steward-owned facility as deeply distressing.

“It was one of the saddest situations I’ve ever been involved in,” Russell expressed.

Florida Doctor’s Experience with Steward

Dr. Charles Fischman believed he had thoroughly assessed Steward Health Care when executives discussed acquiring his internal medicine practice in Vero Beach, Florida, in early 2017. Approaching retirement, he was looking out for his 10,000 patients, as well as two other doctors, a nurse practitioner, and the administrative team.

After meeting Steward’s executives, Fischman found each one more charismatic than the last, and he grew confident that a physician-led organization would take good care of his practice. Steward representatives engaged with his team over breakfast to alleviate their concerns.

“We felt reassured about the situation,” Fischman noted.

However, shortly after Steward assumed control on June 1, 2018, problems began to emerge. Established vendors, including lab providers, raised complaints about unpaid invoices, while local utilities threatened to cut off services due to outstanding bills.

Fischman had a two-year agreement to stay on as a physician and lab director. However, Fischman reported that nothing got better in the weeks and months that followed.

Fischman’s wife, Carol, who worked at the same office, received complaints from local vendors—people the Fischmans had known for 30 years in the community. These vendors were eager to receive payment for their services, needed to cover mortgages and basic living costs, he explained.

During a dinner meeting in Vero Beach with several Steward executives months after the hospital chain acquired the medical practice, Carol inquired about the delayed payments to vendors. Unfortunately, she did not receive a satisfactory response.

“All we got were tales about fishing boats and hospitals in Malta,” he recounted, reflecting on his discussions with Steward executives.

Eventually, out of frustration, his wife left her job. Fischman revealed that executives pressured him to direct patients solely to other physicians employed by Steward. He finally departed from the practice in April 2020 and moved to Tampa, where he continues to see patients a few days a week.

Chiaravalloti, a representative from Steward, did not provide answers regarding the Vero Beach medical facilities.

Challenges Facing Hospitals: Bankruptcy and Closures

State health officials and medical leaders from Massachusetts to Louisiana are currently evaluating how Steward Health Care’s bankruptcy will impact everyday operations, as fresh details about the company’s business conduct and practices continue to emerge.

On August 19, the Massachusetts governor’s office sent a letter to Steward, classifying Carney Hospital as an “essential service” for residents of Dorchester, while recognizing that the state does not possess the “authority to compel” the hospital to remain operational.

Some community leaders are appealing to the governor to ensure the hospital continues to operate.

Bill Walczak, a former president of Carney, remarked that the Dorchester hospital has been troubled by “poor decisions” made over many years, even before Steward’s ownership. However, he asserted that Carney is vital for ensuring access for up to 250,000 residents within its service area. He emphasized that this is a health equity matter for the community. He believes that the state has the capacity to provide a solution.

“Massachusetts is a very affluent state, and it has significant influence,” Walczak stated. “If the legislature, governor, and the secretary of Health and Human Services wanted to create a package today to maintain the essential services at Carney Hospital, they could absolutely do it.”

Walczak pointed out that the Healey administration promised to utilize eminent domain to take control of Steward’s St. Elizabeth’s Hospital in Brighton and transfer it to Boston Medical Center. The governor noted that Boston Medical Center’s readiness to manage St. Elizabeth’s was critical for finalizing the agreement. However, the building’s owner has vowed to contest the seizure, refusing the governor’s initial offer of $4.5 million for the property.

The governor’s representatives and the state’s Department of Public Health did not respond to inquiries about the next steps regarding the hospital acquisition.

Leaders in Dorchester are encouraging the governor to arrange a similar agreement to keep Carney open.

“This isn’t finished,” Walczak mentioned. “Maybe the governor will recognize that numerous lives could be compromised without an emergency room and hospital beds in this part of the city.”